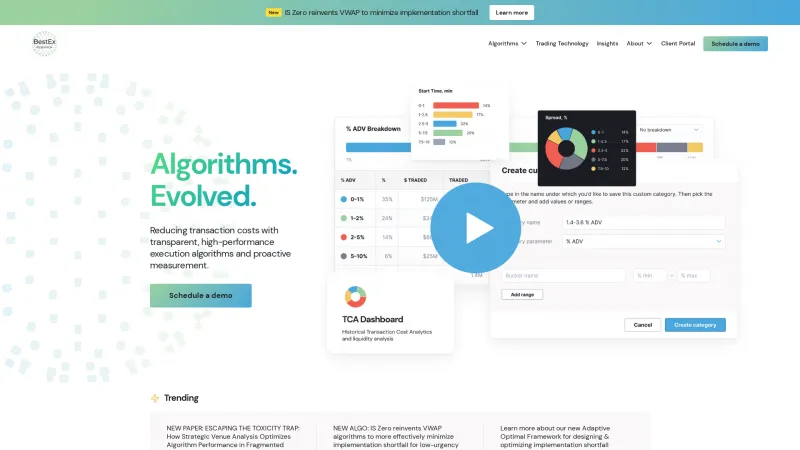

Advanced Algorithmic Trading Software Solutions

Algorithmic trading software automates the process of trading financial instruments by using algorithms to execute trades at optimal times. This software addresses the challenges of speed, accuracy, and emotion in trading, allowing users to capitalize on market opportunities that may arise in milliseconds. Read more

Key features of algorithmic trading software include advanced analytics, backtesting capabilities, real-time data processing, and customizable trading strategies. These tools enable traders to analyze historical data, simulate trading strategies, and execute trades automatically based on predefined criteria, significantly reducing the risk of human error.

This software is best suited for professional traders, hedge funds, and financial institutions that require high-frequency trading capabilities and sophisticated market analysis. Additionally, individual investors with a strong understanding of trading strategies can also benefit from algorithmic trading software to enhance their trading performance and efficiency.