Revolutionize Trading with Automated Market Makers

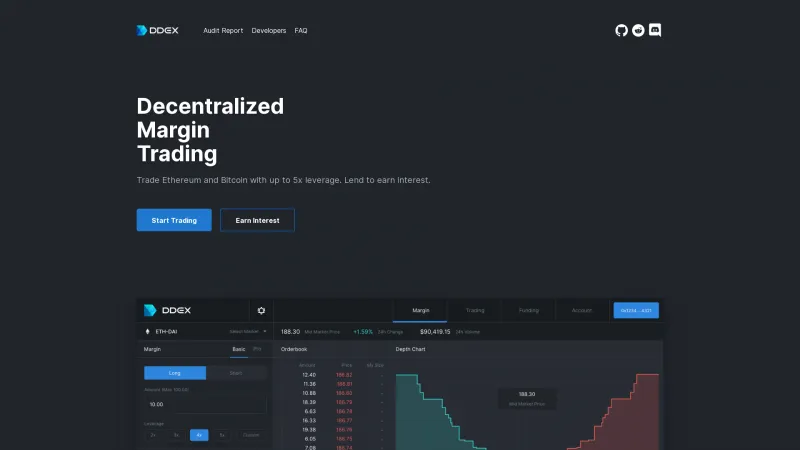

Automated Market Makers (AMM) are a revolutionary type of decentralized exchange protocol that enables users to trade cryptocurrencies without the need for traditional order books. By utilizing smart contracts, AMMs facilitate liquidity provision and price determination through algorithms, allowing users to swap tokens directly from their wallets. Read more

The main features of AMMs include liquidity pools, which are collections of funds provided by users (liquidity providers) that enable trading; dynamic pricing mechanisms that adjust based on supply and demand; and low transaction fees compared to centralized exchanges. These tools solve the problem of illiquidity in markets, ensuring that users can execute trades quickly and efficiently.

AMMs are best suited for cryptocurrency traders, investors, and liquidity providers, particularly in the DeFi (Decentralized Finance) sector. They cater to a wide range of industries, including finance, gaming, and digital asset management, making them an essential component of the evolving blockchain ecosystem.