Essential Backtesting Software for Traders' Success

Backtesting software is a crucial tool for traders and investors looking to evaluate the effectiveness of their trading strategies using historical data. This software allows users to simulate trades based on past market conditions, helping them to identify potential profitability and risk factors before committing real capital. Read more

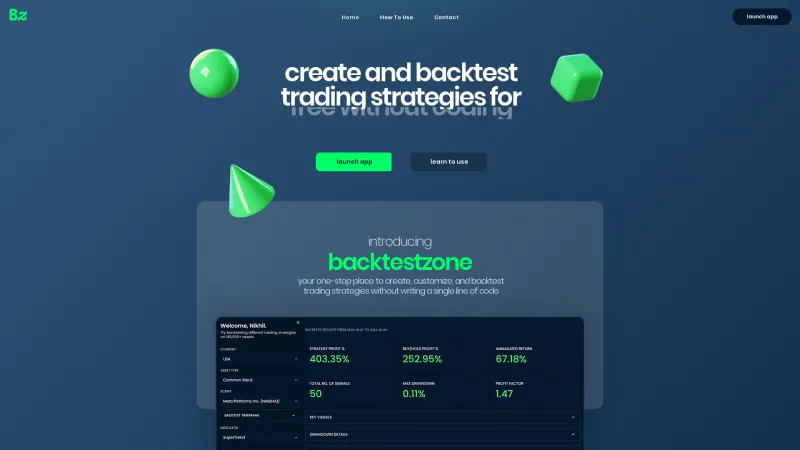

Key features of backtesting software include customizable trading strategies, access to extensive historical data, performance metrics analysis, and risk assessment tools. These features enable users to refine their strategies, optimize parameters, and gain insights into market behavior. Additionally, many backtesting platforms offer user-friendly interfaces and integration with other trading tools, enhancing the overall trading experience.

Backtesting software is best suited for individual traders, financial analysts, and investment firms across various industries, including finance, hedge funds, and algorithmic trading. By utilizing these tools, users can make informed decisions, improve their trading performance, and ultimately increase their chances of success in the financial markets.