Benefits of Buy Now Pay Later Apps

Buy Now Pay Later (BNPL) apps provide consumers with the flexibility to make purchases and pay for them over time, rather than upfront. These applications address the common problem of budget constraints by allowing users to split their payments into manageable installments, often without interest if paid on time. Read more

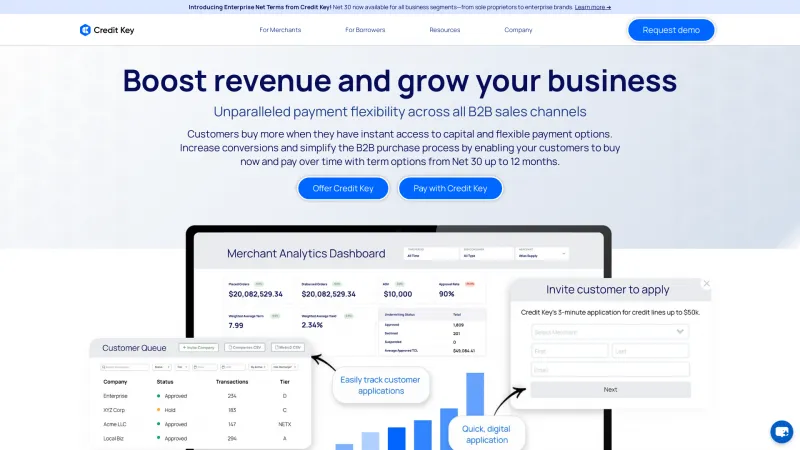

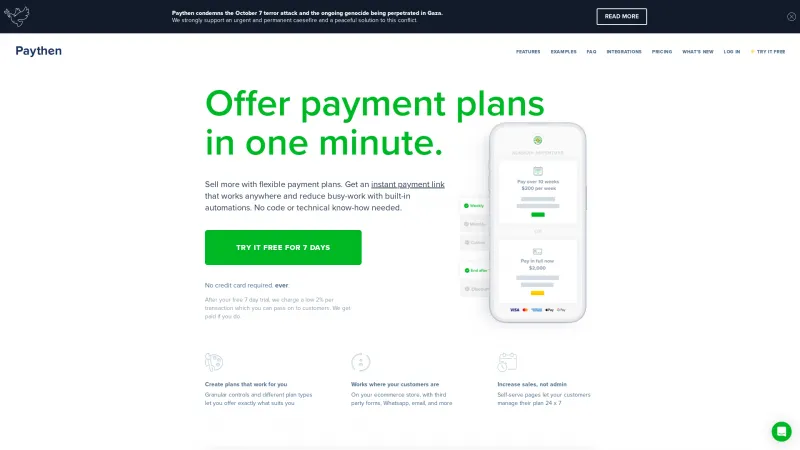

Key features of BNPL apps include instant credit approval, seamless integration with online retailers, and user-friendly interfaces that facilitate easy tracking of payment schedules. Many apps also offer personalized spending limits based on the user's creditworthiness, enhancing the shopping experience while promoting responsible spending.

BNPL apps are particularly suited for millennials and Gen Z consumers who prefer flexible payment options. They are widely used across various industries, including retail, travel, and e-commerce, making them an essential tool for both consumers looking to manage their finances and businesses aiming to increase sales through accessible payment solutions.