Simplify Crypto Tax Reporting with this Software

Crypto tax software is designed to simplify the complex process of calculating and reporting taxes on cryptocurrency transactions. As the popularity of digital currencies grows, so does the need for accurate tax reporting to comply with regulations. This software addresses common challenges such as tracking gains and losses, managing multiple wallets, and ensuring compliance with local tax laws. Read more

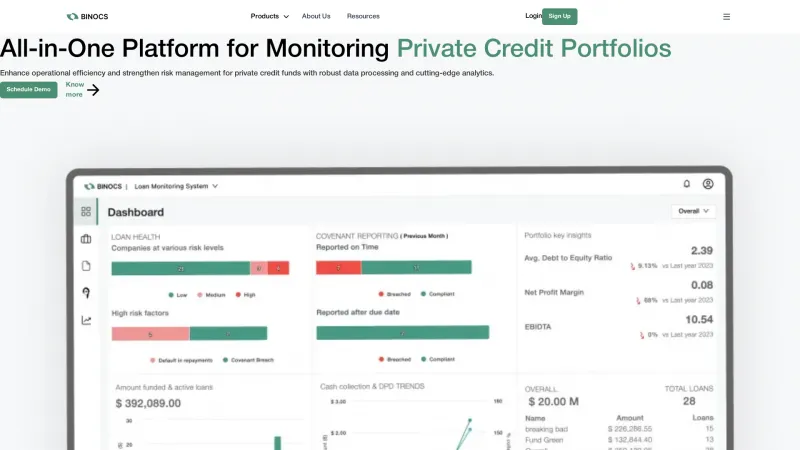

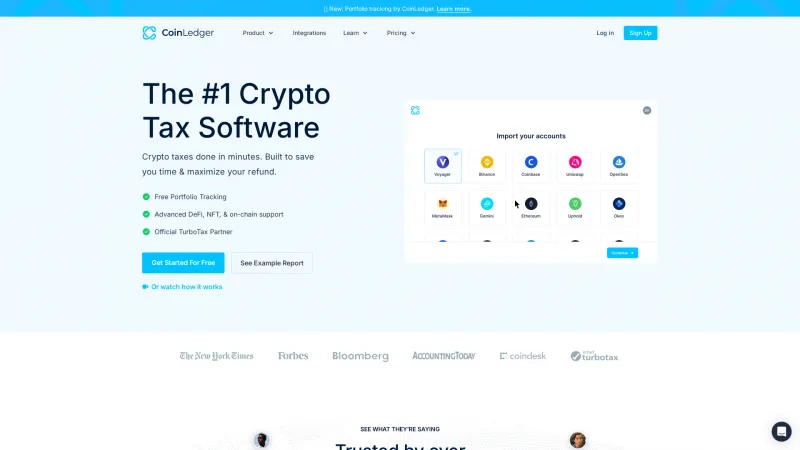

Key features of crypto tax software typically include automated transaction tracking, real-time profit and loss calculations, and integration with various cryptocurrency exchanges and wallets. Many tools also offer tax form generation, making it easier for users to file their returns accurately and on time.

This software is best suited for individual investors, traders, and businesses involved in cryptocurrency transactions. It is particularly beneficial for those who engage in frequent trading or hold diverse portfolios, as it helps streamline the tax reporting process and minimize the risk of errors. Industries such as finance, accounting, and e-commerce are increasingly adopting crypto tax software to manage their tax obligations effectively.