Mobile Banking Software for Enhanced Security and Convenience

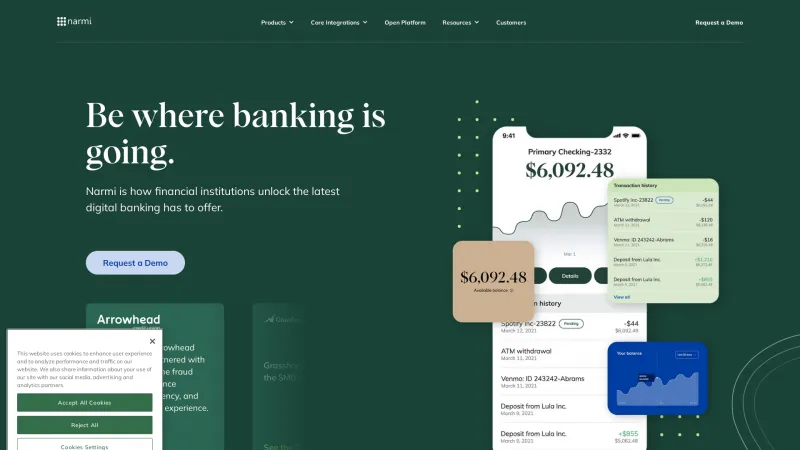

Mobile banking software enables financial institutions to offer banking services through mobile devices, enhancing customer convenience and accessibility. This software addresses the need for secure, on-the-go banking solutions, allowing users to perform transactions, check balances, transfer funds, and manage accounts from anywhere at any time. Read more

Key features of mobile banking software include user-friendly interfaces, robust security measures such as encryption and two-factor authentication, real-time transaction notifications, and integration with various payment systems. Additionally, many solutions offer budgeting tools, account management features, and personalized financial insights, helping users make informed financial decisions.

Mobile banking software is best suited for banks, credit unions, and financial service providers looking to improve customer engagement and streamline operations. It is also beneficial for tech-savvy consumers who prioritize convenience and efficiency in managing their finances. Industries such as retail, e-commerce, and fintech also leverage mobile banking solutions to enhance payment processing and customer experience.