Simplify Sales Tax Management for All Businesses

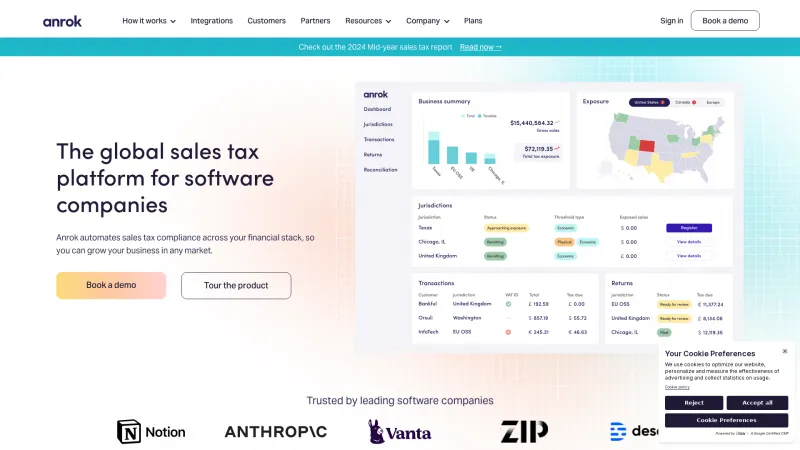

Sales tax software is designed to simplify the complex process of calculating, collecting, and remitting sales tax for businesses. This software addresses common challenges such as varying tax rates across jurisdictions, compliance with local regulations, and the need for accurate reporting. Read more

Key features often include automated tax calculations based on location, integration with e-commerce platforms and accounting systems, and comprehensive reporting tools that help businesses stay compliant with tax laws. Many solutions also offer features for managing exemptions and handling audits, which can save time and reduce the risk of errors.

Sales tax software is best suited for businesses of all sizes, particularly those operating in multiple states or regions. Retailers, e-commerce companies, and service providers can benefit significantly from these tools, as they streamline tax management and help avoid costly penalties associated with non-compliance. By leveraging sales tax software, businesses can focus on growth while ensuring they meet their tax obligations efficiently.