Optimize Tax Strategies with Advanced Planning Software

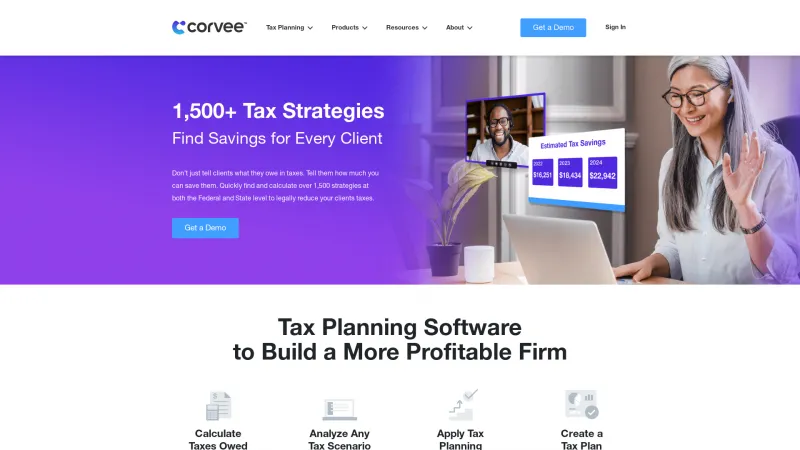

Tax planning software is designed to help individuals and businesses optimize their tax strategies, ensuring compliance while minimizing tax liabilities. These tools provide users with the ability to analyze their financial situations, forecast tax obligations, and identify potential deductions and credits. Read more

Key features often include tax calculators, scenario modeling, and reporting capabilities that allow users to visualize the impact of various financial decisions on their tax outcomes. Additionally, many solutions offer integration with accounting software, making it easier to manage financial data and streamline the tax preparation process.

Tax planning software is best suited for accountants, financial advisors, and small to medium-sized businesses looking to enhance their tax efficiency. It is also beneficial for individuals seeking to make informed decisions regarding investments, retirement planning, and estate management. By leveraging these tools, users can navigate the complexities of tax regulations and make strategic choices that align with their financial goals.