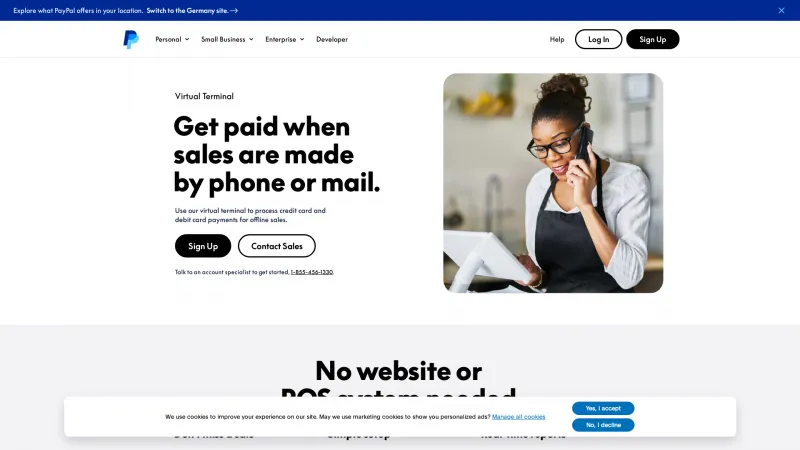

Transform Payment Processing with Virtual Terminals

Virtual terminals are software solutions that enable businesses to process payments remotely, providing a secure and efficient way to handle transactions without the need for physical card readers. These tools are particularly beneficial for industries such as retail, hospitality, and service providers, where mobility and flexibility are essential. Read more

Key features of virtual terminals include the ability to accept credit and debit card payments via a computer or mobile device, integration with existing accounting and inventory systems, and robust security measures to protect sensitive customer information. Additionally, many virtual terminals offer customizable invoicing options and detailed reporting capabilities, allowing businesses to track sales and manage cash flow effectively.

Virtual terminals are best suited for small to medium-sized businesses that require a reliable payment processing solution without the overhead of traditional point-of-sale systems. They are ideal for businesses that operate in various locations or those that provide services directly to customers at their homes or offices. By utilizing virtual terminals, businesses can enhance customer convenience, streamline payment processes, and ultimately improve their overall operational efficiency.