Optimize Your B2B Payments with Balance: Seamless Transactions, Instant Credit Decisions, and Cost Savings

B2B Payment PlatformsTransform your B2B payments with Balance. Enjoy seamless transactions, instant credit decisions, and reduced processing costs. Optimize your financial operations today!

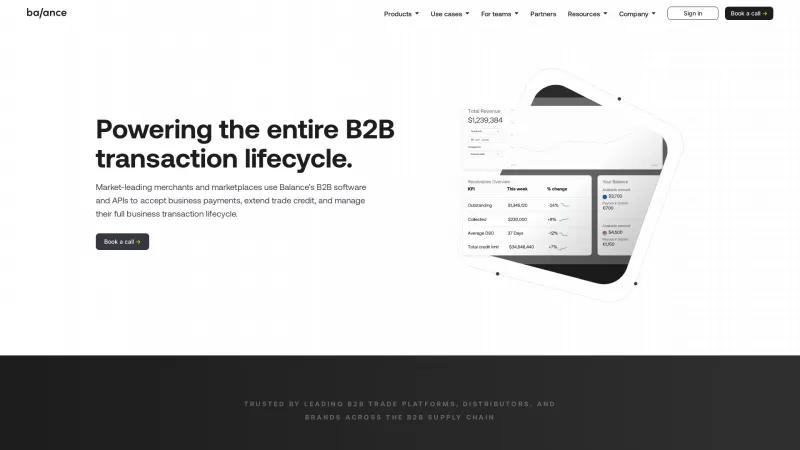

About Balance

Balance stands out as a transformative force in the B2B payments landscape, offering a comprehensive suite of products designed to streamline the entire transaction lifecycle. Their innovative approach to B2B payments, digital trade credit, and accounts receivable management is not only impressive but essential for businesses looking to enhance their operational efficiency.

One of the most notable features of Balance is its ability to facilitate seamless transactions across various platforms and marketplaces. The integration of their robust APIs allows businesses to accept payments, extend trade credit, and manage transactions all in one place. This level of convenience is a game-changer for finance teams and business leaders alike, as it simplifies processes and reduces the time spent on manual tasks.

The instant credit decisioning and automated underwriting processes are particularly commendable. With approval times of less than 30 seconds for credit limits up to $50,000, Balance empowers businesses to make quick decisions that can significantly impact cash flow and customer satisfaction. The ability to offer flexible payment terms—ranging from 30 to 90 days—further enhances the buyer experience, making it easier for companies to manage their finances.

Moreover, Balance's focus on reducing processing costs is evident, with claims of up to 200 basis points in savings. This not only benefits the bottom line but also allows businesses to reinvest those savings into growth initiatives. The platform's self-serve invoicing and automated collections are additional features that contribute to a more efficient accounts receivable process, ultimately leading to decreased days sales outstanding (DSO).

The testimonials from industry leaders, such as Denise Moore from Vallourec and Michael Eichinger from Bay Fastening Systems, highlight the tangible benefits that Balance brings to its clients. Their experiences underscore the platform's flexibility and its ability to integrate seamlessly with existing business processes, which is crucial for companies looking to scale.

Balance is not just a payment solution; it is a strategic partner for businesses aiming to thrive in the digital age. With its user-friendly interface, powerful integrations, and commitment to enhancing the B2B transaction lifecycle, Balance is well-positioned to support organizations in achieving their financial goals. For any business looking to optimize its payment processes and drive growth, Balance is undoubtedly worth considering.

Payment Processing Features

- ACH Check Transactions

- Debit Card Support

- Mobile Payments

- Online Payments

- Receipt Printing

- Recurring Billing

- Signature Capture

Leave a review

User Reviews of Balance

No reviews yet.