Streamline Your Insurance Brokerage Operations with PolicyFlow's Comprehensive Management Software

Insurance Agency SoftwareDiscover PolicyFlow, the ultimate insurance broking management software designed by brokers for brokers. Streamline client management, quotes, and claims with ease.

About PolicyFlow

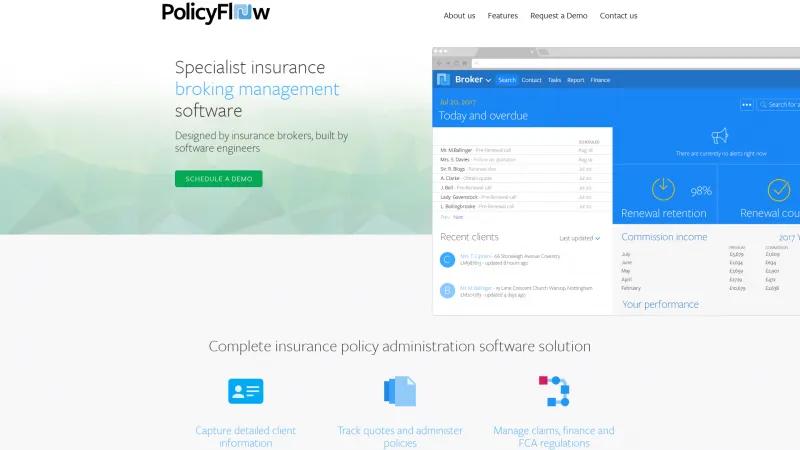

PolicyFlow stands out as a premier insurance broking management software, expertly designed by insurance brokers and built by skilled software engineers. This unique combination ensures that the platform not only meets the technical demands of modern insurance practices but also addresses the real-world challenges faced by brokers daily.

One of the most impressive features of PolicyFlow is its comprehensive client management capabilities. The software allows users to capture detailed client information, manage multiple addresses, and track communications effectively. This level of organization enhances customer relationship management (CRM) and ultimately leads to improved client satisfaction.

The ability to manage and track quotes and policies is another significant advantage. PolicyFlow simplifies the process of recording detailed risk information and automating quote requests from underwriters, which streamlines operations and saves valuable time. Additionally, the software's robust claims management features ensure that brokers can efficiently administer and report on insurance claims while maintaining compliance with FCA regulations.

PolicyFlow's integration capabilities are particularly noteworthy. The software seamlessly connects with popular accounting platforms like QuickBooks, Sage, and Xero, allowing for smooth financial transactions and reporting. Furthermore, the integrated mapping feature provides brokers with a visual representation of client locations, which can be invaluable for risk assessment and marketing strategies.

The document management system is another highlight, offering a simple yet effective approach to creating and managing documentation. With highly configurable templates, brokers can ensure that all documents are FCA compliant while maintaining a consistent brand image. The ability to track document edits and manage versions adds an extra layer of security and organization.

Moreover, PolicyFlow's dynamic risk questionnaires are fully customizable, enabling brokers to capture detailed information about clients' assets efficiently. The integration with underwriters further enhances the software's functionality, allowing for automated quote and renewal requests without the need for redundant data entry.

In terms of reporting and analytics, PolicyFlow excels with its user-friendly dashboards and management information (MI) reports. Brokers can easily export data, run pre-configured reports, and utilize ad hoc reporting to gain insights into their business performance.

Overall, PolicyFlow is a comprehensive solution that empowers insurance brokers to streamline their operations, enhance customer service, and maintain compliance with industry regulations. Its user-friendly interface, robust features, and seamless integrations make it an invaluable tool for any insurance brokerage looking to thrive in a competitive market. I highly recommend scheduling a demo to experience the full capabilities of PolicyFlow firsthand.

Insurance Agency Features

- Claims Management

- Commission Management

- Contact Management

- Document Management

- Insurance Rating

- Life & Health

- Policy Management

- Property & Casualty

- Quote Management

Insurance Policy Features

- Cancellation Tracking

- Claims Tracking

- Policy Generation

- Policy Processing

- Quotes / Estimates

- Rating Engine

- Renewal Management

Leave a review

User Reviews of PolicyFlow

No reviews yet.